Wholesale Revenue Growth

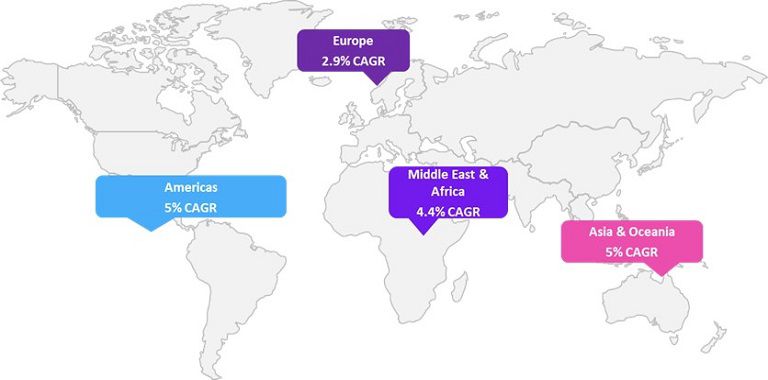

Omdia recently completed its Global Wholesale Market Forecast 2019-25 which tracks wholesale revenue trends for backbone, voice, and mobile services in four regions: Americas, Asia and Oceania, Europe, and Middle East & Africa. The total revenue available to wholesalers for telecoms services was around US$200 billion in 2018. Factoring in the impact of the COVID-19 pandemic, global wholesale revenue across all service areas is forecast to increase to US$267 billion by 2025, a compound annual growth rate (CAGR) of 4.4%. The figure below shows expected growth rates from 2019-2025 by geographic region.

Source: Omdia

The expected growth in wholesale service revenue is the result of a combination of global telecoms market developments:

- The number and variety of organizations that are buying wholesale services is increasing. Traditional service providers and ISPs are joined by aggregators, systems integrators, and the large OTTs and hyperscalers.

- Retail communications services are becoming more complex and dependent on services bought wholesale.

- Many wholesalers are responding to demand from new types of partners by developing and offering higher value services and service bundles.

- The COVID-19 pandemic has altered communications traffic volumes and patterns, including a small, and temporary, uptick in legacy TDM voice services.

Backbone Services Growth Offsets Declines in other Service Areas

Omdia’s international backbone forecast comprises revenues earned by wholesalers for long-distance data service connections and carriage across international borders. The international wholesale forecast includes subsea and terrestrial fiber, wavelengths, IP transit (including VoIP), messaging, CDN, IP VPN, signaling, and private line services.

Lumen Global Network

Explore the Lumen Global Network to support your on-demand business demands

Demand for Global Information and Content Accelerates International Backbone Growth

International backbone revenues are growing faster than any other wholesale service group. Globally, international wholesale backbone revenues are expected to grow from US$45.2 billion in 2019 to US$79.8 billion in 2025, a CAGR of 9.9%. These services are growing fastest in markets where internet usage and cloud models are strong but most content and business information is held outside the country. Additionally, the growing number of competitive communication service providers (CSPs) in domestic markets, many of which do not have their own international operations, need international connectivity.

“

Globally, international wholesale backbone revenues are expected to grow from US$45.2billion in 2019 to US$79.8 billion in 2025, a CAGR of 9.9%

Internet traffic growth in the Americas and Asia and Oceania are leading overall global wholesale revenue growth. As international connectivity options increase, non-US providers are gradually sending less global traffic to transit the US. Globally, the Middle East and Africa (MEA) is the fastest growing region, albeit from a smaller starting point than more developed regions.

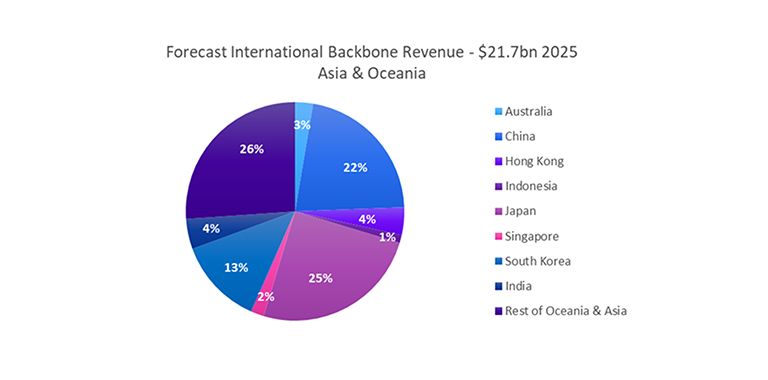

Asia and Oceania

The international wholesale backbone market in the Asia and Oceania region (which includes central and southern Asia) is expected to grow from US$12.1 billion in 2019 to $21.7 billion in 2025. Japan is the single largest market for international backbone services outside the US, due to very high domestic broadband penetration and a high number of international links and is expected to have around 25% of segment revenue in the region by 2025. Revenue growth for this segment in China is expected to be strong due to broadband penetration as the desire for international content grows.

Source: Omdia

National Backbone Growth Depends on Speed of Broadband Rollouts

As with international backbone services, national backbone services are also growing steadily, albeit at a lower CAGR of 5.3%. This segment is expected to increase from US$42.7 billion in 2019 to US$58.2 billion in 2025. Wholesale is a small part of the national backbone markets because many CSPs prefer to sell directly and build their own infrastructure. However, more complex retail services such as 5G and IoT are increasingly dependent on the wholesale market and are expected to spur further growth in this segment.

Regional differences reflect a variety of levels of demand driven by retail broadband penetration and demands from consumers and enterprises for data-based services, including VoIP. In addition, providers in some markets are moving towards higher value managed services, while others favor simpler wholesale services such as dark fiber.

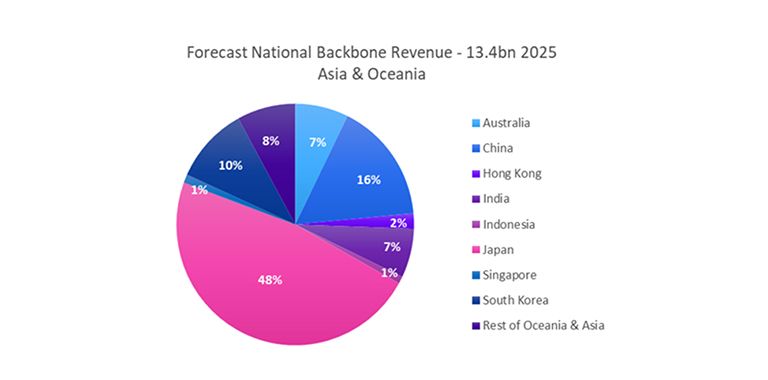

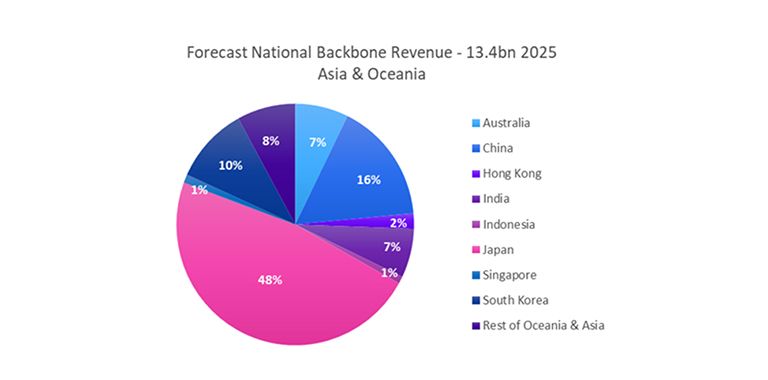

Asia and Oceania

“

In Asia and Oceania, wholesale national backbone revenue growth is expected to increase from US$10.4billion in 2019 to US$13.4 billion in 2025

Wholesale national backbone revenues are growing in all countries in this region. Japan is expected to have the largest share of this market by 2025, at 48%, followed by China with 16%, and South Korea with 10%.

Source: Omdia

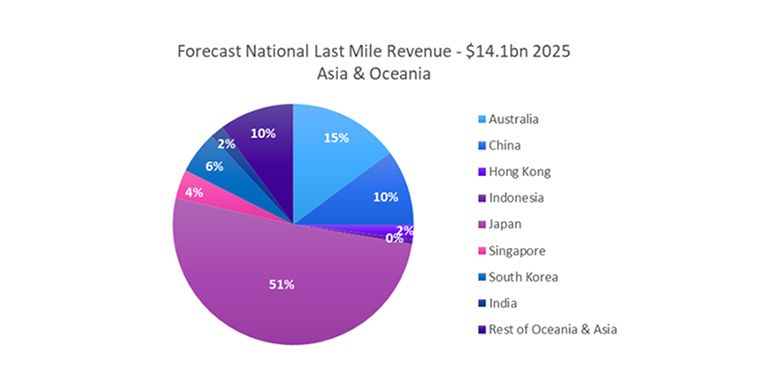

National Last Mile

Omdia’s forecast of national last mile services comprises revenues earned by wholesalers for fixed last-mile broadband connections and carriage. This includes fixed and wireless point-to-point access such as xDSL, fiber, cable leased lines, fixed wireless access (FWA), and satellite. Globally, wholesale national last mile revenues are expected to increase from US$65.9 billion in 2019 to US$88.2 billion in 2025, a CAGR of 5%. Wholesalers are expected to take a larger share of total last mile revenues in markets where broadband penetration is higher, while wholesale growth will be lowest in mature markets where pricing pressure offsets increased connections. Wholesale growth rates are highest where current broadband penetration is comparatively low, such as South Africa, Nigeria, Mexico, and Brazil.

Broadband last mile services are well established in North America, Europe, and some Asia markets. There are regional differences based on different levels of last mile availability and of regulatory intervention to increase broadband roll-out and retail competition. Wholesale last mile services are generally less available in markets where governments retain ownership stakes in incumbent service providers, and where the cost of deployment exceeds return on investment.

Voice Services Continue their Decline

The international voice services forecast include revenues earned by wholesalers for carriage of traditional voice services between countries, including international roaming traffic and termination fees.

The national voice service forecast includes all revenue earned by wholesalers for carriage of fixed and mobile voice services between networks in a single country. Both forecasts exclude revenue from on-net VoIP calls that interconnect with traditional voice services.

Source: Omdia

Large Wholesalers are Consolidating Carriage of International Voice Minutes

International voice revenues continue to fall faster than any other service grouping: global wholesale international voice revenues declined from US$12.7 billion in 2019 to US$7.4 billion in 2025, a CAGR of -8.6%. This segment is in terminal decline due competing IP-based communication services including VoIP and messaging, but the decline will be slow as usage gradually falls away. The drop-off is sharpest in developed markets such as North America and Europe, while Asia and Oceania is forecast to be the largest region in terms of voice revenues by 2025 due to its slower declines.

Declines in this segment open the door to consolidation and outsourcing. An increasing number of national CSPs will outsource their international voice services to more cost-effective international wholesale specialists in response to pricing pressures from dropping retail prices. This outsourcing will increase the wholesale share of international voice revenues in all regions. Consolidation in this segment will create fewer, larger players that will have better economies of scale to support the business that remains.

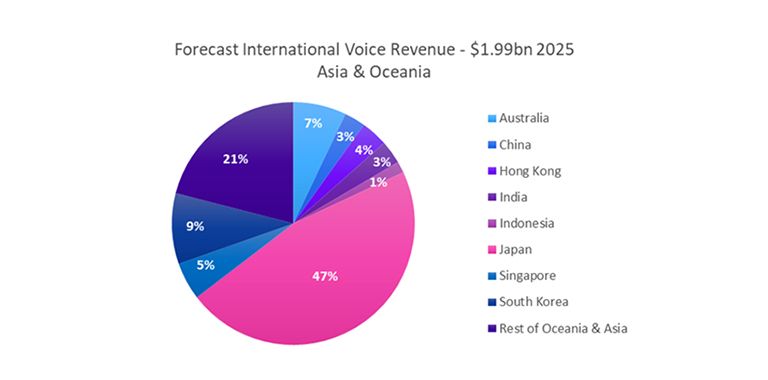

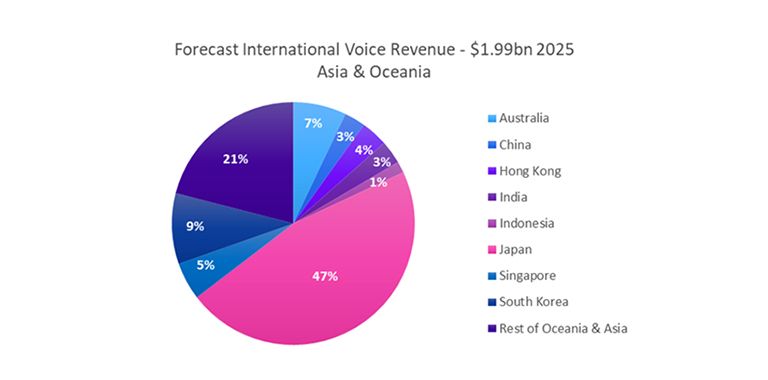

Asia and Oceania

This region is expected to generate around US$2 billion in wholesale international voice revenue by 2025, down from US$2.6 billion in 2019. As is the case globally, all major countries in this region losing legacy voice revenues as users migrate away. Nearly half of this revenue, 47%, will be earned in Japan due to its high international prices, followed by South Korea at 9%. While the COVID-19 pandemic has slowed declines in wholesale international voice revenues for 2020, overall revenue from the region is expected to decline at a CAGR of -4.4%.

Source: Omdia

Wholesale National Voice Revenues Continue to Fall

Wholesale national voice revenues are also falling, from US$23.9 billion in 2019 to US$17.7 billion in 2025 at a CAGR of -4.9%. Revenue is in sharp decline in markets where historically wholesale revenue has been highest, and competition is fierce. For example, in 2019 Europe accounted for 29% of the total market share but is forecast to shrink to 20% by 2025.

As with international voice, national voice revenue declines are due to migration to VoIP and increasing use of messaging services, and wholesalers are carrying an increasing proportion of retail minutes as smaller provider outsource voice traffic. The greatest increases in wholesale national voice will be in markets with the greatest decline in total voice revenue, and where termination rates are high, such as Japan and South Korea.

In markets where retail voice volumes are still growing, wholesale demand is small as incumbents dominate market share. For example, wholesale national voice revenues are expected to grow in the Middle East and Africa between 2019 and 2021 but are expected to decline thereafter.

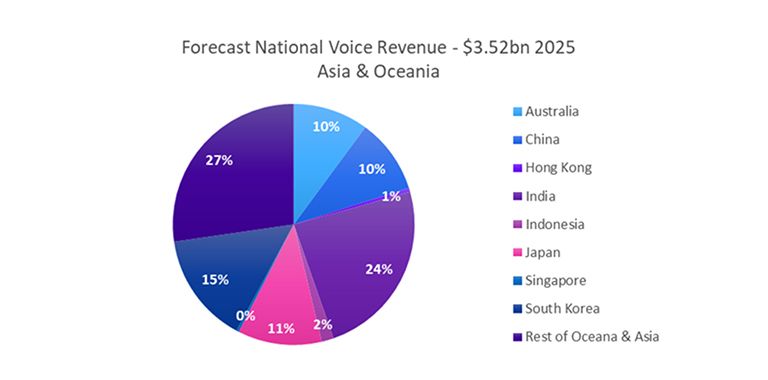

Asia and Oceania

While COVID-19 has pushed voice revenues up temporarily, over the longer-term wholesale national revenues in the region are expected to decline at a CAGR of around 4.9%. India is the largest wholesale voice market in Asia and Oceania and is expected to generate around US$840 million, or 24%, of total revenue, followed by South Korea with 15% and Japan with 11%.

Source: Omdia

This content is provided for informational purposes only and may require additional research and substantiation by the end user. In addition, the information is provided “as is” without any warranty or condition of any kind, either express or implied. Use of this information is at the end user’s own risk. Lumen does not warrant that the information will meet the end user’s requirements or that the implementation or usage of this information will result in the desired outcome of the end user. This document represents Lumen’s products and offerings as of the date of issue. Services not available everywhere. Business customers only. Lumen may change or cancel products and services or substitute similar products and services at its sole discretion without notice. All third-party company and product or service names referenced in this article are for identification purposes only and do not imply endorsement or affiliation with Lumen. ©2022 Lumen Technologies. All Rights Reserved.

Interested to know more?

Find out how you can work with your preferred wholesale partner to accelerate growth, increase efficiency, and improve customer experiences today.

Cindy Whelan

Cindy Whelan leads the Enterprise Networks and Wholesale team, heading research focusing on service provider and vendor strategies across enterprise WAN, LAN, and wholesale services.